UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Securities Exchange Act of 1934

Filed by the Registrant x☑

Filed by a partyParty other than the Registrant ¨☐

Check the appropriate box:

☑ Preliminary Proxy Statement

☐Confidential, for use of the Commission Only (as permitted byRule 14a-6(e) (2))

☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

Milestone Scientific Inc.

(Name of Registrant as Specified In Itsin its Charter)

(Name of Person(s) Filing Proxy Statement, if other thanOther Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☑ | ||||

No fee required. | ||||

☐ | ||||

Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11. | ||||

1. | Title of each class of securities to which transaction applies: | |||

2. | Aggregate number of securities to which transaction applies: | |

3. | (Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

4. | Proposed maximum aggregate value of transaction: | |

5. | Total fee paid: | |||

☐ | Fee paid previously with preliminary materials. |

☐ | ||||

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the | ||||

(1) | Amount Previously Paid: | |||

| ||||

Form, Schedule or Registration Statement No.: | ||||

(3) | Filing Party: | |

| ||||

Date Filed: | ||||

Milestone Scientific Inc.

MILESTONE SCIENTIFIC INC.

Notice of Annual Meeting of Stockholders

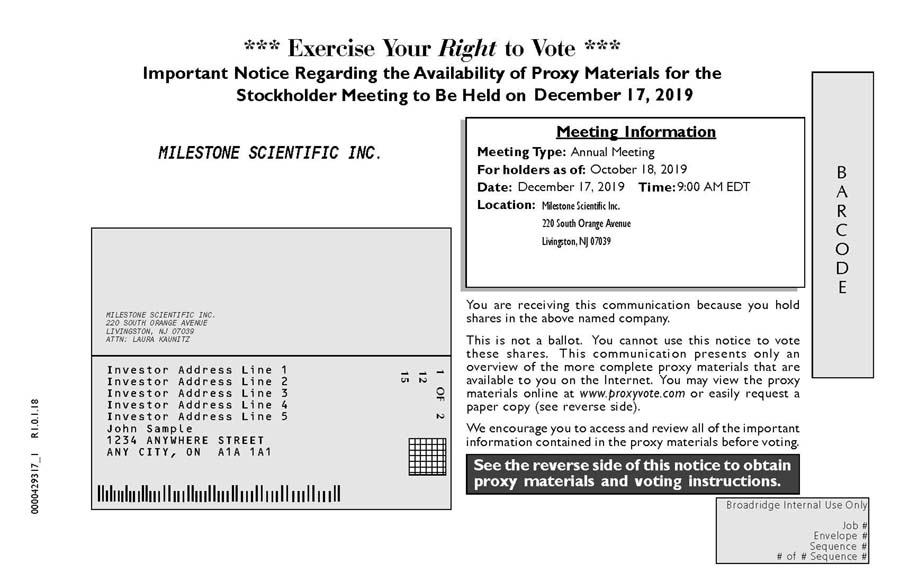

To be held on May 25, 2016December 17, 2019

To the Stockholders of Milestone Scientific Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Milestone Scientific Inc. (“Milestone” or the “Company”) will be held at Golenbock Eiseman Assor Bell & Peskoe LLP, 437 Madison220 South Orange Avenue, New York, New YorkSuite 102, Livingston, NJ 07039 on May 25, 2016December 17, 2019 at 9:00 AM, Eastern Time, for the purpose of considering and acting upon the following:

1. | Election of |

2. | Approval to amend the Corporation’s Restated Certificate of Incorporation increasing the number of authorized shares of Common Stock from 50,000,000 shares to 75,000,000 |

3. | Approval of a non-binding advisory resolution relating to compensation of the Company’s Named Executive Officers |

4. | Approval of |

5. | Ratification of the appointment of |

6. | Such other business as may legally come before the meeting and any adjournments or postponements thereof. |

The Board of Directors (the “Board”) has fixed the close of business on March 28, 2016October 18, 2019 as the record date (the “Record Date”) for determining the stockholders having the right to notice of and to vote at the meeting.

By order of the Board of Directors

Leslie Bernhard

Chairman of the Board

Livingston, New Jersey

April 15, 2016[November 6], 2019

IMPORTANT: Every stockholder, whether or not he or she expects to attend the annual meeting in person, is urged to execute the proxy and return it promptly in the enclosed business reply envelope. Sending in your proxy will not prevent you from voting your stock at the meeting if you desire to do so, as your proxy is revocable at your option. We would appreciate your giving this matter your prompt attention.attention

*******

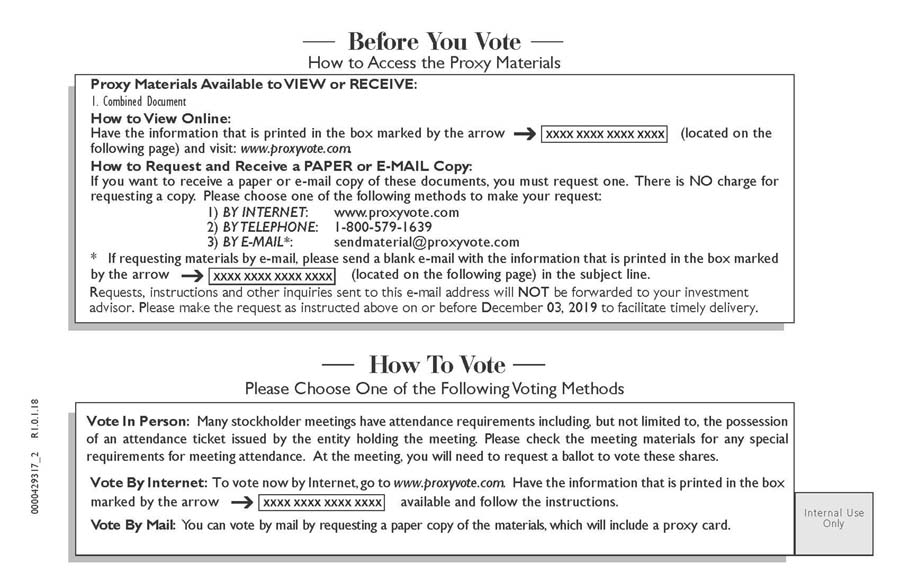

Important Notice Regarding Internet Availability of Proxy Materials for the Annual Meeting of

Stockholdersto be held on May 25, 2016: December 17, 2019:

The Proxy Statement and Annual Report are available at www.https://materials.proxyvote.com/59935Pproxyvote.com.

* * * * * * *

*******

MILESTONE SCIENTIFIC INC.

PROXY STATEMENT

For Annual Meeting of Stockholders

To be Held on May 25, 2016December 17, 2019

Proxies in the form enclosed with this statement are solicited by the Board of Directors (the “Board”) of Milestone Scientific Inc. (“we”, “us”, “our”, the “Company” or “Milestone”“Milestone Scientific”) to be used at the Annual Meeting of Stockholders (the “Annual Meeting”) and any adjournments thereof, to be held at Golenbock Eiseman Assor Bell & Peskoe LLP, 437 Madison220 South Orange Avenue, New York, New YorkSuite 102 , Livingston , NJ 07039 on May 25, 2016December 17, 2019 at 9:00 AM, Eastern Time, for the purposes set forth in the Notice of Meeting and this Proxy Statement. The Board knows of no other business which will come before the meeting. This Proxy Statement and the accompanying proxy will beare being mailed to stockholders on or about April 15, 2016.[November 6], 2019.

THE VOTING AND VOTE REQUIRED

Record Date and Quorum

Only stockholders of record at the close of business on March 28, 2016October 18, 2019 (the “Record Date”) are entitled to notice of and vote at the Annual Meeting. On the Record Date, there were 21,687,16448,199,073 outstanding shares of common stock, par value $.001 per share (“Common Stock”) and 7,000 outstanding shares of our Series A Convertible Preferred Stock, par value $.001 per share (“Preferred Stock”). Each share of Common Stock is entitled to one vote, and each share of Preferred Stock is entitled to approximately 392.93 votes. In the aggregate, the holders of all classes, voting as a single class, may cast 24,437,655 votes at the Annual Meeting.vote. Shares represented by each properly executed, unrevoked proxy received in time for the Annual Meeting will be voted as specified. A quorum will be present at the Annual Meeting ofif stockholders owning not less than one-third of the shares issued and outstanding on the Record Date are present at the meeting in person or by Proxy.

Voting of Proxies

The persons acting as proxies pursuant to the enclosed proxy will vote the shares represented as directed in the signed proxy. Unless otherwise directed in the proxy, the proxyholders will vote the shares represented by the proxy: (i) for the election of the five (5)seven (7) director nominees named in this Proxy Statement; (ii) for the approval to amend the Corporation’s Restated Certificate of Incorporation increasing the number of authorized shares of Common Stock from 50,000,000 shares to 75,000,000 shares; (iii) for the approval of the amendments to the 2011 Stock Option Plan (described below); (iii) for approval of thea non-binding advisory resolution relating to the compensation of the Company’s Named Executive Officers; (iv) for 3-years as to the frequency of holding non-binding advisory approvalresolutions relating to compensation of the Company’s Named Executive Officers; (v) for the ratification of the appointment of Baker Tilly Virchow Krause,Friedman LLP as the Company’sMilestone Scientific’s independent auditors for the fiscal year ending December 31, 2016;2019; and (v)(vi) in the proxyholders’ discretion, on any other business that may come before the meeting and any adjournments of the meeting.thereof.

All votes will be tabulated by the Inspector of Elections appointed for the Annual Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. Under the Company’sMilestone Scientific’s bylaws and Delaware law: (1) shares represented by proxies that reflect abstentions or “broker non-votes” (i.e., shares held by a broker or nominee that are represented at the Annual Meeting, but with respect to which such broker or nominee is not empowered to vote on a particular proposal) will be counted as shares that are present and entitled to vote for purposes of determining the presence of a quorum; (2) there is no cumulative voting, and the director nominees receiving the highest number of votes, up to the number of directors to be elected, are elected and, accordingly, abstentions, broker non-votes and withholding of authority to vote will not affect the election of directors; and (3) proxies that reflect abstentions and broker non-votes will be treated as unvoted for purposes of determining approval of that proposal and will not be counted as votes for or against that proposal.

Voting Requirements

Election of Directors.The election of the director nominees will require a plurality of the votes cast on the matter at the Annual Meeting. With respect to the election of directors, votes may be cast in favor of or withheld with respect to each nominee. Votes that are withheld will be excluded entirely from the vote and will have no effect on the outcome of the vote.

Approval to Amend the Restated Certificate of Incorporation to increase the number of Authorized Shares of Common Stock from 50,000,000 to 75,000,000.The affirmative vote of the amendments to the 2011 Stock Option Plan, approvalmajority of the shares issued and outstanding cast by stockholders entitled to vote at the Annual Meeting is required to approve this matter. An abstention will be treated as “present” for quorum purposes. Abstention's and broker non-votes will have the same effect as an against vote on the matter.

Advisory approval of a non-binding advisory resolution relating to the compensation of the Company’s Named Executive Officers.The affirmative vote of a majority of the votes cast on the matter by stockholders entitled to vote at the Annual Meeting is required to approve this matter. An abstention will be treated as “present” for quorum purposes. Abstention's will have the same effect as an against vote on the matter and broker non-votes will have no effect on the matter.

Advisory approval of a non-binding resolution relating to athe frequency of non-binding advisory votes on dvisory approvalcompensation of the Company’s Named Executive Officers.The number of years receiving the greatest number of votes (i.e. one, two or three years) will be considered the frequency recommended by stockholders. An abstention will be treated as “present” for quorum purposes. Abstention's and broker non-votes will have no effect on the matter.

Ratification of the appointment of independent auditors.Independent Auditors. The affirmative vote of a majority of the votes cast on the matter by stockholders entitled to vote at the Annual Meeting is required to approve each of these matters.this matter. An abstention will be treated as “present” for quorum purposes. However, sinceAbstention's will have the same effect as an abstention is not treated as a “vote” for or against vote on the matter itand broker non-votes will have no effect on the outcome of the vote on either matter.

1 of 18

Revocability of Proxy

Proxy. A proxy may be revoked by the stockholder giving the proxy at any time before it is voted by delivering oral or written notice to the Corporate Secretary of Milestone Scientific at or prior to the Annual Meeting, and a prior proxy is automatically revoked by a stockholder giving a subsequent proxy or attending and voting at the Annual Meeting. Attendance at the Annual Meeting in and of itself does not revoke a prior proxy.

Expenses of Solicitation

Solicitation. Milestone Scientific will pay the expenses of the preparation of proxy materials and the solicitation of proxies for the Annual Meeting. In addition to the solicitation of proxies by mail, solicitation may be made by certain directors, officers or employees of Milestone Scientific telephonically, electronically or by other means of communication. Milestone Scientific will reimburse brokers and other nominees for costs incurred by them in mailing proxy materials to beneficial owners in accordance with applicable rules.

PROPOSAL 1

ELECTION OF DIRECTORS

(ITEMItem 1 ON THE PROXY CARD)on the Proxy Card)

The Board currently consists of fiveseven directors: Leslie Bernhard, Leonard A. Osser, Leonard M. Schiller, Gian Domenico Trombetta, and Edward J. Zelnick, M.D.M.D, Michael McGeehan and Neal Goldman. Directors are elected for a term of one year and until the next Annual Meeting of Stockholders and until their successors are duly elected and qualified. The Nominating Committee (described below), with the concurrence of the Board, has nominated the present directors for re-election to the Board at the Annual Meeting.

It is intended that votes pursuant to the enclosed proxy will be cast for the election of the nominees named below. In the event thatIf any such nominee should become unable or unwilling to serve as a director, the proxy will be voted for the election of such person, if any, as shall be designated by the Board. Management has no reason to believe that any of these nominees will not be available to serve as a director if re-elected.

The following table sets forth the names and ages of each nominee, the positions and the period during which each has served as a director of Milestone.Milestone Scientific. Information as to the stock ownership of each nominee is set forth under “Security Ownership of Certain Beneficial Owners and Management.” All of the director nominees to the Board have been approved and nominated by the Nominating Committee (described below), with the concurrence of the Board, for re-election to the Board.

The names, ages and titles of our directors and nominees, as of the Record Date, are as follows:

NAME | AGE | POSITION | DIRECTOR SINCE | AGE | POSITION | DIRECTOR SINCE | |||

Leslie Bernhard (1) (2) (3) | 71 | Chairman of the Board and Director | 2003 | 74 | Chairman of the Board | 2003 | |||

Leonard Osser | 68 | Chief Executive Officer and Director | 1991 | 71 | Interim Chief Executive Officer and Director | 1991 | |||

Leonard Schiller (1) (2) (3) | 75 | Director | 1997 | 78 | Director | 1997 | |||

Michael McGeehan (1) | 53 | Director | 2017 | ||||||

Gian Domenico Trombetta | 55 | Director | 2014 | 58 | Director | 2014 | |||

Edward J. Zelnick, M.D. (1) (2) (3) | 70 | Director | 2015 | 73 | Director | 2015 | |||

Neal Goldman | 75 | Director | 2019 | ||||||

1. Member of the Audit Committee

2. Member of the Compensation Committee

3. Member of the Nominating Committee

Recommendation of the Board

The Board recommends that the stockholders vote “FOR” the election of all the nominees as directors.

********

2 of 18

The principal occupations and brief summaries of the backgrounds, as of the Record Date, of the directors and nominees are as follows:

Leslie Bernhard, Chairman of the Board

Leslie Bernhard has been Milestone’s non-executiveserved as Milestone Scientific’s Chairman of the Board since September 2009.October 2009 and served as Interim Chief Executive Officer from October 2017 to December 2017. In addition, Ms. Bernhard has also had been sserving as an Independent Director (as defined below)independent director of Milestone Scientific since May 2003. She co-founded AdStar, Inc. and from 1986 to 2012,Since 2017, Ms. Bernhard has been an independent director of Sachem Capital Corp (NYSE American: SACH) a Connecticut based real-estate investment trust. From 2007, Ms. Bernhard served as its President, Chief Executive Officer and Executive Director. Ms. Bernhard serves on the Board of Directorsan independent director of Universal Power Group, Inc., a global supplier of Dallas, TX,power solutions until it became a manufacturerprivate company in 2018. In 1986 she co-founded AdStar, Inc., an electronic ad intake service to the newspaper industry, and distributor of batteriesserved as its president, chief executive officer and battery related products.executive director until 2012. Ms. Bernhard holds a BS Degree in Education from St. John’s University. Ms. Bernhard’s professional experience and background with AdStar and with us, as one of our directors since 2003, have given her the expertise needed to serve as Chairman of the Board.Board, and Chairman of the Audit Committee.

Leonard Osser, Interim Chief Executive Officer and Director

Leonard Osser has been Milestone’sInterim Chief Executive Officer and a director since September 2009.December 2017. From July 2017 to December 2017, he had been Managing Director – China Operations. Prior to that, he served as Milestone Scientific’s Chairman from 1991 until September of 2009, and during that time, from 1991 until 2007, was also Chief Executive Officer of Milestone.Milestone Scientific. In September 2009, he resigned as Chairman of Milestone Scientific, but remained a director, and assumed the position of Chief Executive Officer. From 1980 until the consummation of Milestone’sMilestone Scientific’s public offering in November 1995, Mr. Osser was primarily engaged as the principal owner and Chief Executive Officer of U.S. Asian Consulting Group, Inc., a New Jersey-based provider of consulting services specializing in distressed or turnaround situations in both the public and private markets. Mr. Osser’s knowledge of our business and background with us since 1980 provides the Board with valuable leadership skills and insight into our business.

Leonard M. Schiller, Director

Leonard Schiller has been a director of Milestone since April 1997. Mr. Schiller has been a partner in the Chicago law firm of Schiller, Klein & McElroy,business and P.C. since 1977. He has also been President of The Dearborn Group, a residential property management and real estate acquisition company since 1980. Mr. Schiller became a Director of the Gravitas Cayman Corporation in February 2010. Gravitas Cayman Corporation is an Investment Fund. Mr. Schiller’s professional experience and background as an attorney and a partner of a law firm and with us, as one of our directors since 1997, have given himaccordingly, the expertise needed to serve as one of our directors.

Gian Domenico Trombetta, Director

Gian Domenico Trombetta becamehas been a director of Milestone Scientific in May 2014 and the President and Chief Executive Officer of Milestone’sMilestone Scientific’s Dental Division (Wand Dental Inc.) since October 2014. He founded Innovest S.p.A in 1993, a- private equity anda special situation investment firm acting in development and distressed capital investments. He has been its President and Chief Executive Officer since 1996.its inception. He servesserved as the Chief Executive Officer or a board member of numerousseveral private commercial companies in different industries including both industrial (e.g. IT, media, web, and fashion) and holding companies. Before founding Innovest, Mr. Trombetta was Project Manager for Booz Allen & Hamilton Inc., a management consulting firm from 1988 to 1992. Mr. Trombetta holds a degree in business administration from the Luiss University in Rome, Italy and aan MBA degree from INSEAD-Fontainbleau-France. Mr. Trombetta business background and experience has given him the expertise needed to serve as one of our directors.

Leonard M. Schiller, Director

Leonard Schiller has been a director of Milestone Scientific since April 1997. Mr. Schiller has been a partner in the Chicago law firm of Schiller Strauss & Lavin PC since 1977 and since 2002, its President. Mr. Schiller also serves as a director on the boards of Jerrick Media Holdings, Inc., a public media company, since February 2016 and Point Capital, Inc., a business development company, since July 2014. Mr. Schiller’s professional experience and background have given him the expertise needed to serve as Chairman of the Compensation Committee and as one of our directors.

Edward J. Zelnick, M.D., Director

Edward J. Zelnick, M.D. has been a director of Milestone Scientific since February 2015. Dr. Zelnick has been a medical doctor for over 45 years and has a background in clinical research. Since June 2002 he has been the chief executive officer of Horizon Institute for Clinical Research, a company that assemblesrecruits test subjects and clinicians for clinical research organizations.trials. Dr. Zelnick received a Bachelor of Science degree in chemistry from the University of Pittsburgh in 1966 and his M.D. degree from New York Medical College in 1970. Dr. Zelnick’sZelnick's professional experience and background as a medical doctor and in clinical research, have given him the expertise needed to serve as one of our directors. Dr. Zelnick became

Michael McGeehan

Michael McGeehan has been a director of Milestone Scientific since October 2017. Mr. McGeehan is a business consultant with 30 years of experience in February 2015.

3Mr. McGeehan was on the Board of 18Directors of Wand Dental Inc., (subsidiary of Milestone Scientific) a maker of a painless, anesthetic injection system for dentists. Mr. McGeehan has a Master’s in Business Administration from Pace University and a Bachelor of Science in Electrical Engineering and Computer Science from Marquette University. Mr. McGeehan’s background has given him the experience needed to serve as one of our directors.

Neal Goldman

Mr. Goldman is the President and Founder of Goldman Capital Management, Inc., a family office since 2018, which was previously an investment advisory firm founded in 1985. He was First Vice President of Research at Shearson Lehman Hutton. He has also held senior positions as a money manager and research analyst with a variety of firms including Neuberger Berman, Moseley Hallgarten Estabrook and Weeden, Bruns Nordeman, and Russ and Company. Mr. Goldman serves as Chairman of Charles & Colvard, Ltd. (Nasdaq: CTHR) since 2016 and serves on the board of Imageware Systems, Inc. (Nasdaq: IWSY). He also serves on the board of Deep Down Inc. (DPDW). Prior to their acquisition, he served on the boards of Blyth Industries and IPASS Corporation. Mr. Goldman is a Chartered Financial Analyst (CFA). He also serves on numerous non-profit boards. Mr. Goldman received his B.A. degree in Economics from The City University of New York (City College).

Board Leadership Structure

The Board believes that the segregation of the roles of Board Chairman and the Chief Executive Officer ensures better overall governance of the Company and provides meaningful checks and balances regarding its overall performance. This structure allows our Chief Executive Officer to focus on developing and implementing the Company’s business plans and supervising the Company’s day-to-day business operations and allows our Chairman to lead the Board in its oversight and advisory notes.roles. Because of the many responsibilities of the Board and the significant time and effort required by each of the Chairman and the Chief Executive Officer to perform their respective duties, the Company believes and having separate persons in these roles enhances the ability of each to discharge those duties effectively and enhances the Company’s prospects for success. The Board also believes that having separate positions provides a clear delineation of responsibilities for each position and fosters greater accountability of management. For the foregoing reasons, the Board had determined that its leadership structure is appropriate and in the best interest of the stockholders.

The Board’s Oversight of Risk Management

The Board recognizes that companies face a variety of risks, including credit risk, liquidity risk, strategic risk, and operational risk. The Board believes an effective risk management system will (1) timely identify the material risks that we face; (2) communicate necessary information with respect to material risks to senior executives and, as appropriate, to the Board or relevant Board committee; (3) implement appropriate and responsive risk management strategies consistent with the Company’s risk profile; and (4) integrate risk management into Company decision-making. The Board encourages, and management promotes a corporate culture that incorporates risk management into the Company’s corporate strategy and day-to-day business operations. The Board also continually works, with the input of management and executive officers, to assess and analyze the most likely areas of future risk for the Company.

Committees of the Board

The Board has standing audit, compensation and nominating and corporate governance committees (respectively, the “Audit Committee,” the “Compensation Committee,” and the “Nominating and Corporate Governance Committee.”)

Attendance at Committee and Board Meetings

In 2015,2018, the Board held a total of eightnine meetings; the Audit Committee held a total of four meetings, the Compensation Committee held a total of fourone meetings; and the Nominating and Corporate Governance Committee did not meet.held no meeting in 2018. Each of our directors attended 100% of the aggregate of the total number of meetingsat least 80% of the Board meetings and all of the meetings of the committees of the Board on which he or she served. It is our policy to invite and encourage all the directors to attend the Annual Meeting. All of our then directors attended our annual meeting of stockholders in 2015.2018.

Compensation Committee

The Compensation Committee reviews and recommends to the Board the compensation and benefits of all officers of the Company, reviews general policy matters relating to compensation and benefits of employees of the Company and administers the issuance of stock options to the Company’s officers, employees, directors and consultants. The Compensation Committee is comprised of three members, Leslie Bernhard, Leonard M. Schiller Leslie Bernhard and Dr. Edward J. Zelnick, M.D.Zelnick. A copy of the Compensation Committee Charter has been posted on our Web sitewebsite atwww.milestonescientific.com.

Audit Committee

The Audit Committee was established to meetmeets with management and the Company’s independent accountants to determine the adequacy of internal controls and other financial reporting matters. The Audit Committee’s purpose is to: (A) assist the Board in its oversight of: (i) the integrity of our financial statements; (ii) our compliance with legal and regulatory requirements; (iii) our independent auditors’ qualifications and independence; (iv) the performance of our internal audit function and independent auditors to decide whether to appoint, retain or terminate our independent auditors; and (v) the preparation of our Annual Report on Form 10-K for the fiscal year ended December 31, 2015;2018 (the “Annual Report”); and (B) to pre-approve all audit, audit-related and other services, if any, to be provided by the independent auditors. The members of the Audit Committee isare comprised of Leslie Bernhard, and Leonard M. Schiller, Edward J. Zelnick, M.D and Edward Zelnick, M.D.Michael McGeehan., all of whom are independent as defined in the listing standards of the NYSE MKTAmerican and Section 10A(m)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Board adopted a revised written charter for the Audit Committee in July 2005 (the “Charter”). A copy of the Audit Committee Charter has been posted on our Web sitewebsite atwww.milestonescientific.com.

4 of 18

Audit Committee Financial Expert

The Board has determined that Leslie Bernhard is an “audit committee financial expert,” as that term is defined in Item 407(d)(5) of Regulation S-K, and “independent” for purposes of the listing standards of the NYSE MKTAmerican and Section 10A(m)(3) of the Exchange Act.

Nominating and Corporate Governance Committee

The Nominating Committee identifies potential director nominees and evaluates their suitability to serve on the Board. Based on its evaluation, it recommends to the Board formedthe director nominees for Board membership. In addition, the Nominating Committee also regularly evaluates each existing Board member’s suitability for continued service as a Nominating and Corporate Governance Committee in May 2004.director. The members of the Nominating and Corporate Governance Committee are Leonard M. Schiller, Leslie Bernhard and Edward J. Zelnick, M.D. A copy of the Nominating Committee Charter has been posted on our website at www.milestonescientific.com.

The Nominating Committee believes that the minimum qualifications for service as a director of the Company are that a nominee possess an ability, as demonstrated by recognized success in his or her field, to make meaningful contributions to the Board’s oversight of the business and Corporate Governance Committee has dual responsibilities.affairs of the Company and an impeccable reputation of integrity and competence in his or her personal or professional activities. The Nominating and Corporate Governance Committee will assistCommittee’s criteria for evaluating potential candidates include the Board by identify and recommending individuals qualified to become memberfollowing: an understanding of the Board. Additionally,Company’s business environment; and the committee will evaluatepossession of such knowledge, skills, expertise and diversity of experience so as to enhance the sizeBoard’s ability to manage and compositiondirect the affairs and business of the Company including, when applicable, to enhance the ability of committees of the Board and its members, reviewing governance issues and making recommendations to the Board regarding possible changes and reviewing and monitoring compliance with the code of ethics and insider trading policy.fulfill their duties and/or satisfy any independence requirements imposed by law, regulation or listing requirements.

The Nominating and Corporate Governance Committee will considerconsiders director candidates recommended by stockholders. In considering candidates submitted by stockholders, the committee will take into consideration the needs of the Board and the qualifications of the candidate. The Nominating and Corporate Governance Committee may also take into consideration the number of shares held by the recommending stockholder and the length of time that such shares have been held. To have a candidate considered by the Nominating and Corporate Governance Committee, a stockholder must submit the recommendation in writing and must include the following information: the name of the stockholder and evidence of the person’s ownership of Company stock, including the number of shares owned and the length of time of ownership; the name of the candidate, the candidate’s resume or a listing of his or her qualifications to be a director of the Company; and, the person’s consent to be named as a director if selected by the Nominating Committee and nominated by the Board.

The stockholder recommendation and information described above must be sent to the Company’s Chief Financial Officer at 220 South Orange Avenue, NJ 07039 and must be received not less than 120 days prior to the anniversary date

The Nominating and Corporate Governance Committee believes that the minimum qualifications for service as a director of the Company are that a nominee possess an ability, as demonstrated by recognized success in his or her field, to make meaningful contributions to the Board’s oversight of the business and affairs of the Company and an impeccable reputation of integrity and competence in his or her personal or professional activities. The Nominating and Corporate Governance Committee’s evaluation of potential candidates shall be consistent with the Board’s criteria for selecting new directors. Such criteria include an understanding of the Company’s business environment and the possession of such knowledge, skills, expertise and diversity of experience so as to enhance the Board’s ability to manage and direct the affairs and business of the Company, including when applicable, to enhance the ability of committees of the Board to fulfill their duties and/or satisfy any independence requirements imposed by law, regulation or listing requirements.

The Nominating and Corporate Governance Committee may also receive suggestions from current Board members, the Company’s executive officers or other sources, which may be either unsolicited or in response to requests from the committeeNominating Committee for such candidates. The Nominating and Corporate Governance Committee also, from time to time, may engage firms that specialize in identifying director candidates.

Once a person has been identified by the Nominating and Corporate Governance Committee as a potential candidate, the committeeit may collect and review publicly available information regarding the person to assess whether the person should be considered further. If the Nominating and Corporate Governance Committee determines that the candidate warrants further consideration, the Chairmanchairman or another member of the Nominating Committee may contact the person. Generally, if the person expresses a willingness to be considered and to serve on the Board, the committeeNominating Committee may request information from the candidate, review the person’s accomplishments and qualifications and may conduct one or more interviews with the candidate. The Nominating and Corporate Governance Committee may consider all such information in light ofconsidering information regarding any other candidates that the committeeit might be evaluating for membership on the Board. In certain instances, Nominating and Corporate Governance Committee members may contact one or more references provided by the candidate or may contact other members of the business community or other persons that may have greater first-hand knowledge of the candidate’s accomplishments. The Nominating and Corporate Governance Committee’s evaluation process does not vary based on whether or not a candidate is recommended by a stockholder, although, as stated above, the Board may take into consideration the number of shares held by the recommending stockholder and the length of time that such shares have been held.

5 of 18

Additionally, the Nominating and Corporate Governance Committee will assist the Board on corporate governance. Specifically, the Nominating and Corporate Governance Committee will evaluate the size and composition of the Board and its members, reviewing governance issues and making recommendations to the Board regarding possible changes and reviewing and monitoring compliance with the code of ethics and insider trading policy.

The Nominating and Corporate Governance Committee adopted a revised written charter in July 2005, which is available to security holders on Milestone’s website atwww.milestonescientific.com.

Director Independence

The Board has determined that of Leslie Bernhard, Leonard M. Schiller, Leslie Bernhard and Edward J. Zelnick, M.D., Michael McGeehan and Neal Goldman (the “Independent Directors”), are independent as that term is defined in the listing standards of the NYSE MKT. As disclosed above, Leslie Bernhard, Leonard Schiller and Edward Zelnick, M.D., are the members of all three committees of the Board and are independent for such purposes.

American. In determining director independence, the Board also considered any and all equity awards, if any, to the Independent Directors for the year ended December 31, 2015,2018, disclosed in “Director Compensation” below, and determined that such awards were compensation for services rendered to the Board and therefore did not impact their ability to continue to serve as Independent Directors.

Stockholder Communication with the Board

The Board has established a process to receive communications from stockholders. Stockholders and other interested parties may contact any member (or all members) of the Board, or the non-management directors as a group, any Board committee or any chair of any such committee by mail or electronically. To communicate with the Board, any individual director or any group or committee of directors, correspondence should be addressed to the Board or any such individual directors or group or committee of directors by either name or title. All such correspondence should be sent “c/o Corporate Secretary” at 220 South Orange Avenue, Livingston, NJ 07039. All communications received as set forth in the preceding paragraph will be opened by the Corporate Secretary of the Company for the sole purpose of determining whether the contents represent a message to our directors. Any contents that are not in the nature of advertising, promotions of a product or service, patently offensive material or matters deemed inappropriate for the Board will be forwarded promptly to the addressee. In the case of communications to the Board or any group or committee of directors, the Company’s Corporate Secretary will make sufficient copies of the contents to send to each director who is a member of the group or committee to which the envelope or e-mail is addressed.

6

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

The following table, together with the accompanying footnotes, sets forth information, as of March 28, 2016,October 18 2019 , regarding stock ownership of all persons known by Milestone Scientific to own beneficially more than 5% of Milestone’sMilestone Scientific’s outstanding common stock, the Named Executives, Officers, all directors, and all directors and officers of Milestone Scientific as a group:

Names of Beneficial Owner (1) | Shares of Common Stock Beneficially Owned (2) | Percentage of Ownership |

| Shares of Common |

|

|

| Percentage of |

| ||||||||

Executive Officers and Directors |

|

|

|

|

|

|

|

|

| ||||||||

Leonard Osser | 3,463,330 | (3) | 13.54 | % |

|

| 4,475,805 |

| (3) |

|

| 8.97 | % | ||||

Joseph D’Agostino | 1,495,511 | (4) | 5.85 | % | |||||||||||||

Joseph D'Agostino |

|

| 1,543,658 |

| (4) |

|

| 3.09 | % | ||||||||

Leslie Bernhard |

|

| 75,000 |

| (5) |

|

| * |

| ||||||||

Leonard Schiller | 172,033 | * |

|

| 257,528 |

| (6) |

|

| * |

| ||||||

Edward J. Zelnick, M.D. |

|

| 69,870 |

| (7) |

|

| * |

| ||||||||

Michael McGeehan |

|

| 141,607 |

| (8) |

|

| * |

| ||||||||

Neal Goldman | 1,338,226 | (9) | 2.68 | % | |||||||||||||

Gian Domenico Trombetta | 4,861,881 | (5) | 19.01 | % |

|

| 10,310,538 |

| (10) |

|

| 20.66 | % | ||||

Leslie Bernhard | 0 | — | |||||||||||||||

Edward J. Zelnick, M.D. | 0 | — | |||||||||||||||

All directors & executive officers as group (7 persons) | 9,997,162 | (6) | 39.09 | % | |||||||||||||

Beneficial Owners of More Than 5% | |||||||||||||||||

All directors & executive officers as group (8 persons) |

|

| 18,212,232 |

|

|

|

| 36.49 | % | ||||||||

K. Tucker Andersen | 3,125,744 | 12.22 | % |

|

| 3,400,975 |

|

|

|

| 7.26 | % | |||||

Robert Gintel | 1,403,500 | 5.49 | % | ||||||||||||||

Tom Cheng |

|

| 2,015,629 |

|

|

|

| 4.00 | % | ||||||||

* Less than 1% |

|

|

|

|

|

| |||||||||||

1. | The addresses of the persons named in this table are as follows: Leonard Osser, Joseph |

2. | A person is deemed to be a beneficial owner of securities that can be acquired by such person within 60 days from |

3. | Includes |

4. | Includes |

5. | Includes 75,000 shares |

6. | Includes 257,528 shares |

7. | Includes 69,870 shares |

8. | Includes |

9. | Includes 1,195,726 shares held by Mr. Goldman and 142,500 shares subject to warrants to purchase common stock of the Company. |

10. | Includes 202,617 shares to be issued at the termination of his employment, |

7 of 18

Securities Authorized for Issuance under Equity Compensation Plans

Equity Compensation Plan Information

The following table summarizes, as of December 31, 2015,2018, the (i) options granted under ourthe Milestone Scientific 2004 Stock Option Plan (the “2004 Plan”) and (ii) options granted under ourthe Milestone Scientific 2011 Equity Compensation Plan (f/k/a Milestone Scientific 2011 Stock Option Plan.Plan) (the “2011 Plan”). The shares covered by outstanding options and warrants are subject to adjustment for changes in capitalization, stock splits, stock dividends and similar events. No other equity compensation has been issued.

| Number of Securities to be issued upon exercise of outstanding options and warrants | Weighted-average exercise price of outstanding options and warrants | Number of securities remaining available for future issuance under equity compensation plan | ||||||||||||||||||||||

Equity compensation plan approved by stockholders | Number of Securities to be issued upon exercise of outstanding options and warrants | Weighted-average exercise price of outstanding options and warrants | Number of securities remaining available for future issuance under equity compensation plan | |||||||||||||||||||||

Grants under our 2004 Stock Option Plan (1) | 73,333 | $ | 1.49 | 0 | 73,333 | $ | 1.49 | - | ||||||||||||||||

Grants under our 2011 Stock Option Plan (2) | 1,860,010 | $ | 1.72 | 139,990 | 1,630,220 | $ | 1.64 | 1,007,587 | ||||||||||||||||

|

| |||||||||||||||||||||||

Total | 1,933,343 | 139,990 | 1,703,553 | $ | 1.71 | 1,007,587 | ||||||||||||||||||

|

| |||||||||||||||||||||||

1. | The 2004 |

2. | The 2011 |

Stock Plan

In December 2007, the Board authorized Milestone to issue up to $1 million of its common stock to vendors or employees, and to grant them piggy back registration rights in the usual form, at a value of not less than 90% of the market value on the date of the agreement for the vendor or employee to accept said shares. Such future shares are not included in the above noted shares reserved for future issuance. At December 31, 2015 and 2014 there were $11,316, respectively, available to be issued under this plan.

PROPOSAL NO. 2

APPROVAL OF AMENDMENTS TO THE 2011 STOCK OPTION PLAN TO CHANGE THE NAME OF THE PLAN, TO PROVIDE FOR AWARDS OF SHARES OF THE COMPANY’S COMMON STOCK AND TO INCREASE THE MAXIMUM NUMBER OF SHARES WHICH MAY BE ISSUED THEREUNDER FROM 2,000,000 TO 4,000,000

(ITEM 2 ON THE PROXY CARD)

In March 2016 the Board adopted, subject to stockholder approval, amendments (the “Amendments”) to the 2011 Stock Option Plan (the “2011 Plan”): (i) changing the name of the 2011 Plan to the “Milestone Scientific Inc. 2011 Equity Compensation Plan”; (ii) providing for awards of shares of the Company’s common stock; and (iii) increasing the maximum number of shares which may be issued thereunder from 2,000,000 to 4,000,000. The Board determined that the Amendments are in the Company’s best interests and recommends approval by the stockholders. A copy of the Amendment to the 2011 Plan is attached as Appendix A to this Proxy Statement.

8 of 18

Background and Reason for the Proposal

In order to continue our program of equity-based incentive compensation to attract and retain the personnel necessary for our success and to provide more flexibility to the Compensation Committee, our Board has approved the Amendments. The Board’s reasons for the Amendments are as follows:

The purpose of the 2011 Plan is to provide incentives to our employees, directors and consultants whose performance will contribute to our long-term success and growth, to strengthen Milestone’s ability to attract and retain employees, directors and consultants of high competence, to increase the identity of interests of such people with those of our stockholders and to help build loyalty to Milestone through recognition and the opportunity for stock ownership. The 2011 Plan is administered by the Compensation Committee.

As of the Record Date, the approximate number of employees who are eligible to participate in the 2011 Plan is 15 including four executive officers. The approximate number of non-employee Board members who are eligible to participate in the 2011 Plan is three and we do not currently have any consultants that we are considering for participation in the 2011 Plan.

As of the Record Date, under the 2011 Plan we had outstanding options covering a total of 1,860,010 shares of Milestone common stock. Of these options, options for 576,095 shares are held by Leonard Osser, our Chief Executive Officer, options for 562,971 shares are held by Joseph D’Agostino, our Chief Financial Officer and options for 132,780 shares are held by Gian Domenico Trombetta, President and Chief Executive Officer of our Dental Division (Wand Dental Inc.). The balance of the outstanding options, options for 588,164 shares, are held by various officers and other employees and directors and have a weighted average exercise price of $1.72.

Terms of Options

The 2011 Plan permits the granting of both incentive stock options and nonqualified stock options. Generally, the option price of both incentive stock options and non-qualified stock options must be at least equal to 100% of the fair market value of the shares on the date of grant. The maximum term of each option is ten years. For any participant who owns shares possessing more than 10% of the voting rights of Milestone’s outstanding shares of common stock, the exercise price of any incentive stock option must be at least equal to 110% of the fair market value of the shares subject to such option on the date of grant and the term of the option may not be longer than five years. Options become exercisable at such time or times as the Compensation Committee may determine at the time it grants options.

Federal Income Tax Consequences

We believe that under current law the following U.S. Federal income tax consequences generally would arise with respect to option and stock awards under the 2011 Plan.

Non-qualified Stock Options. The grant of non-qualified stock options will have no immediate tax consequences to the Company or the grantee. The exercise of a non-qualified stock option will require an employee to include in his gross income the amount by which the fair market value of the acquired shares on the exercise date (or the date on which any substantial risk of forfeiture lapses) exceeds the option price. Upon a subsequent sale or taxable exchange of the shares acquired upon exercise of a non-qualified stock option, an employee will recognize long or short-term capital gain or loss equal to the difference between the amount realized on the sale and the tax basis of such shares. Milestone will be entitled (provided applicable withholding requirements are met) to a deduction for Federal income tax purposes at the same time and in the same amount as the employee is in receipt of income in connection with the exercise of a non-qualified stock option.

9 of 18

Incentive Stock Options. The grant of an incentive stock option will have no immediate tax consequences to Milestone or its employee. If the employee exercises an incentive stock option and does not dispose of the acquired shares within two years after the grant of the incentive stock option nor within one year after the date of the transfer of such shares to him (a “disqualifying disposition”), he will realize no compensation income and any gain or loss that he realizes on a subsequent disposition of such shares will be treated as a long-term capital gain or loss. For purposes of calculating the employee’s alternative minimum taxable income, however, the option will be taxed as if it were a non-qualified stock option.

Common Stock.Generally, unless the participant elects, pursuant to Section 83(b) of the U.S. Internal Revenue Code of 1986, as amended, to recognize income in the taxable year which the Milestone common stock had been awarded, the participant is required to recognize income for federal income tax purposes in the first taxable year during which the participant’s rights over the Milestone common stock are transferable or are not subject to a substantial risk of forfeiture, whichever occurs earlier. At such time, we will be entitled (provided applicable withholding requirements are met) to a deduction for Federal income tax purposes.

Plan Benefits Under the 2011 Plan

Future awards under the 2011 Plan will be granted in the discretion of the Compensation Committee. The type, number, recipients, and other terms of such future awards cannot be determined at this time. Information regarding our recent practices with respect to annual incentive awards and stock-based compensation under existing plans is presented in the “Executive Compensation” and “Outstanding Equity Awards at December 31, 2015” elsewhere in this Proxy Statement and in our financial statements for the fiscal year ended December 31, 2015 included in the Annual Report on Form 10K for the year ended December 31, 2015 which accompanies this Proxy Statement.

Recommendation of the Board of Directors

The Board recommends that the stockholders vote “FOR” the approval of the amendments to the 2011 Plan.

********

EXECUTIVE OFFICERS

The following table sets forth the names, ages and principal positions of the executive officers of the Company and two key employees as of the Record Date.

| AGE |

|

| |

| ||||

Leonard | 71 | Interim Chief Executive Officer | ||

| 50 | President | ||

Joseph | 67 | Chief Financial Officer and Chief Operating Officer | ||

Gian Domenico Trombetta | 58 | President and Chief Executive Officer of Milestone’s Dental Division (Wand Dental Inc.) | ||

| ||||

Eugene Casagrande, D.D.S. | 74 | Director of International Professional Relations | ||

Mark Hochman, D.D.S. | 59 | Director of Clinical Affairs |

The principal occupation and business experience, for at least the last five years, for each executive officer and key employees, respectively, is set forth below (except for Messrs.Mr. Osser and Mr. Trombetta whose business experiences are discussed above). There are no family relationships among any of our directors or executive officers.

Steven F. Robins, President

Steven RobinsBrent Johnston, President

Brent Johnston has been Milestone Scientific's President since September 2019. Mr. Johnston is a senior level, medical device industry executive with over 25 years of experience in sales, marketing and organizational efficiency. Prior to joining the Company, Mr. Johnston served as Vice President of MilestoneSales at Clariance, a spinal device company, since 2016. From 2015 until December 2016, Mr. Johnston served as Chief Executive Officer at ExsoMed, an upper extremity orthopedic company. Mr. Johnston founded and Milestone Medical since January 1,served as Chief Operating Officer at Aurora Spine, Inc., from 2011 until 2015. Mr. Robins has an extensive backgroundJohnston held senior executive roles at Phygen Spine (from 2009 until 2011) and Lanx, Inc. (from 2007 until 2009). Mr. Johnston also founded Corvus Medical, Inc., a company focused on products in the healthcare industryspine, orthopedics, biologics and has been working with Milestone ondurable goods, in 2004. Mr. Johnston received a consulting basis since July 2014. Mr. Robins has held both general managementBachelor’s degree in Political Science and marketing positions at Bausch & Lomb, Johnson & JohnsonBusiness Administration from Eastern Washington University and Pfizer. Prior to July 2014, Mr. Robins was employed at Bausch & Lomb Vision Care, in the positionsreceived a Master of President North AmericaBusiness Administration from May 2009 to

10

August 2011 and promoted to Global Chief Marketing Officer from September 2011 to August 2014. Prior to Bausch & Lomb, Mr. Robins was a Vice President and General Manager of Johnson & Johnson’s Consumer Healthcare Business unit in Canada from November 2006 to April 2009. From April 1994 to October 2006, he was at Pfizer Consumer Healthcare, where he held a series of roles including Group Marketing Director Upper Respiratory. Mr. Robins holds a Bachelor of Arts degree in History from Bates College, Lewiston, Maine.

Joseph D’Agostino, Chief Financial Officer and Chief Operating Officer

Joseph D’AgostinoD'Agostino has been Milestone’sMilestone Scientific's Chief Financial Officer since October 2008 and Chief Operating Officer since September 2011. Mr. D’AgostinoD'Agostino joined Milestone Scientific in January 2008 as Acting CFO and has over 25 years of finance and accounting experience serving both publicly and privately held companies. A results-oriented and decisive leader, he has specific proven expertise in treasury and cash management, strategic planning, information technology, internal controls, Sarbanes-Oxley compliance, operations and financial and tax accounting. Mr. D’AgostinoD'Agostino served as Senior Vice President and Treasurer of Summit Global Logistics, a publicly traded, full service international freight forwarder and customs broker with operations in the United States and China.

Previous executive posts also included Executive Vice President and CFO of Haynes Security, Inc., a leading electronic and manned security solutions company serving government agencies and commercial enterprises; Executive Vice President of Finance and Administration for Casio, Inc., the U.S. subsidiary of Casio Computer Co., Ltd., a leading manufacturer of consumer electronics with subsidiaries throughout the world; and Manager of Accounting and Auditing for Main Hurdman’sHurdman's National Office in New York City (merged into KPMG). Mr. D’AgostinoD'Agostino is a Certified Public Accountant and holds memberships in the American Institute of CPA’s,CPA's, New Jersey Society of CPA’s,CPA's, Financial Executive Institute, Consumer Electronics Industry Association and Homeland Security Industry Association. He is a graduate of William Paterson University where he earned a Bachelor of Arts degree in Science.

Mark Hochman, D.D.S., Director of Clinical Affairs

Mark Hochman, D.D.S. has served as Milestone Scientific’s Director of Clinical Affairs and Director of Research and Development since 1999. He has a DoctorateDoctor of Dental Surgery with advanced training in the specialties of Periodontics and Orthodontics from New York University of Dentistry and has been practicing dentistry since 1984.

He holdsis a faculty appointment as aformer clinical associate professor at NYU School of Dental Surgery. Recognized as a world authority on Advanced Drug Delivery Instruments, Dr. Hochman has published numerous articles in this area, and shares in the responsibility for inventing much of the technology currently available from Milestone.Milestone Scientific.

Dr. Eugene Casagrande, Director of International & Professional Relations

Since 1998, Eugene Casagrande, D.D.S. has served as Director of International and Professional Relations, charged with pursuing a broad range of clinical and industry-related strategic business opportunities for Milestone Scientific He has also lectured both nationally and internationally at over 35 dental schools and in over 22 countries on Computer-Controlled Local Anesthesia Delivery.Scientific. Dr. Casagrande has practiced Cosmetic and Restorative Dentistry for over 30 years in Los Angeles. He is past president of the California State Board of Dentistry and the Los Angeles Dental Society and is a Fellow of the American and International Colleges of Dentists and has served onDentists. Dr. Casagrande was a member of the faculty of the University of Southern California, School of Dentistry

There are no family relationships among anyDentistry. He was also the Executive Director of our directors or executive officers.

11

COMPENSATION OF DIRECTORS AND OFFICERS AND RELATED MATTERS

Executive Compensation

The following Summary Compensation Table sets forth all compensation earned, in all capacities, during the fiscal years ended December 31, 2015 and 2014 by Milestone’s (i) CEO and (ii) two most highly compensated executive officers other than the CEO who was serving as an executive officer at the end of the 2015 fiscal year and whose salary as determined by Regulation S-K, Item 402, exceeded $100,000 (the individuals falling within categories (i) and (ii) are collectively referred to as the “Named Executive Officers”).

SUMMARY COMPENSATION TABLE

Name and Principal Position | Year | Salary | Bonuses | Other Compensation | Option Awards (2) | Total | ||||||||||||||||||

Leonard A. Osser | ||||||||||||||||||||||||

Chief Executive Officer | 2015 | $ | 300,000 | $ | 300,000 | (1) | $ | 236,267 | (2) | $ | 400,000 | $ | 1,236,267 | |||||||||||

| 2014 | $ | 300,000 | $ | 400,000 | (1) | $ | 234,310 | (2) | $ | 200,000 | $ | 1,134,310 | ||||||||||||

Gian Domenico Trombetta | ||||||||||||||||||||||||

Chief Executive Officer - Wand Dental Inc | 2015 | $ | 120,000 | $ | 160,000 | (3) | $ | — | (2) | $ | 320,000 | $ | 600,000 | |||||||||||

| 2014 | $ | 120,000 | $ | 80,000 | (3) | $ | — | (2) | — | $ | 200,000 | |||||||||||||

Joseph D’Agostino | ||||||||||||||||||||||||

Chief Financial Officer | 2015 | $ | 171,600 | $ | 114,500 | (3) | $ | 44,983 | (2) | $ | 229,000 | $ | 560,083 | |||||||||||

| 2014 | $ | 171,600 | $ | 206,750 | (3) | $ | 33,460 | (2) | $ | 413,500 | $ | 825,310 | ||||||||||||

Name and Principal Position |

| Year |

| Salary |

|

| Bonuses |

|

| Option Awards (7) |

|

| Other Compensation |

|

| Total |

| |||||

Leonard A. Osser (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interim Chief Executive Officer |

| 2018 |

| $ | 304,167 |

|

| $ | - |

|

| $ | - |

|

| $ | 236,317 |

|

| $ | 540,484 |

|

Managing Director of Asian Operations |

| 2017 |

| $ | 205,000 |

|

| $ | 350,000 |

|

| $ | 336,970 |

|

| $ | 227,311 |

|

| $ | 1,119,281 |

|

Leslie Bernhard |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interim Chief Executive Officer |

| 2017 |

| $ | 50,000 |

|

| $ | 29,500 |

|

| $ | - |

|

| $ | - |

|

| $ | 79,500 |

|

Daniel Goldberger (2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Former Chief Executive Officer |

| 2017 |

| $ | 68,750 |

|

| $ | - |

|

| $ | - |

|

| $ | 178,600 |

|

| $ | 247,350 |

|

Gian Domenico Trombetta (3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chief Executive Officer - Wand Dental Inc |

| 2018 |

| $ | 280,000 |

|

| $ | - |

|

| $ | - |

|

| $ | - |

|

| $ | 280,000 |

|

|

| 2017 |

| $ | 280,000 |

|

| $ | 180,000 |

|

| $ | - |

|

| $ | - |

|

| $ | 460,000 |

|

Joseph D'Agostino (4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chief Financial Officer and Chief Operating Officer |

| 2018 |

| $ | 200,000 |

|

| $ | - |

|

| $ | - |

|

| $ | 25,298 |

|

| $ | 225,298 |

|

|

| 2017 |

| $ | 178,700 |

|

| $ | 90,000 |

|

| $ | 86,650 |

|

| $ | 27,027 |

|

| $ | 382,377 |

|

Sharon Smith (5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Executive Vice President Global Marketing |

| 2018 |

| $ | 167,535 |

|

| $ | 116,500 |

|

| $ | - |

|

| $ | - |

|

| $ | 284,035 |

|

Eric Gilbert (6) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vice President US Sales and Marketing |

| 2018 |

| $ | 155,242 |

|

| $ | 70,000 |

|

| $ | - |

|

| $ | - |

|

| $ | 225,242 |

|

1. | Leonard Osser deferred a portion of |

2. | On October 2, 2017, Milestone Scientific accepted the resignation of the then CEO, Daniel Goldberger. Included in other compensation is $175,000 for severance per the agreement with Mr. Goldberger dated February 2018 and $3,600 related to health insurance and car allowance. |

| The |

3. | Gian Domenico Trombetta deferred a portion of his yearly compensation of approximately $180,000 in 2018. Mr. Trombetta did not receive a performance bonus in 2018 however, he received $180,000, in a performance bonus for the year ended December 31, |

4. | Joseph D’Agostino deferred a portion of |

5. | Sharon Smith received $116,500, in a performance bonus for the year ended December 31, 2018, and was paid in common stock upon the termination of her employment with the Company. Ms. Smith resigned as the Company’s Executive Vice President Global Marketing effective September 13, 2019. |

6. | Eric Gilbert received $70,000, in a performance bonus for the year ended December 31, 2018, and will be paid in common stock upon the termination of his employment with the Company. |

7. | The amounts in this column reflect the fair value of the options on the date of grant. Compensation cost is generally recognized over the vesting period of the award. See the table entitled Outstanding Equity Awards at December 31, 2018 |

Employment Contracts

As of September 1, 2009,

In July 2017, Milestone Scientific entered into a five-yearthree-year employment agreement with Leonard OsserDaniel Goldberger to serve as itsPresident and Chief Executive Officer. The termOfficer of the 2009 agreement is automatically extended for successive one-year periods unless prior to August 1 of any year, either party notifies the other that he or it chooses not to extend the term.Milestone Scientific. Under the 2009 agreement, the CEO receivesMr. Goldberger would receive base compensation of $300,000 per year. In addition, the CEO,annum and may additionally earn annual bonuses of up to an aggregate of $400,000, payable one half in cash and one half in Milestone Scientific common stock (“Bonus Shares”) contingent upon achieving targetsperformance benchmarks periodically set for each year by the Compensation Committee.compensation committee of the Board. In addition if into any yearsuch shares of the term of the agreement the CEO earns a bonus, he shall also be granted five-yearcommon stock, Mr. Goldberger was entitled to receive stock options (“Bonus Options”) to purchaseacquire twice the number of bonus shares earned. Eachany Bonus Shares earned, pursuant to a non-qualified stock option grant agreement under Milestone Scientific’s then existing equity compensation plan. The Bonus Options had a five-year term and were to vest in equal annual installments on each of the first, second and third anniversary of the grant date, subject to continued employment on such option is to be exercisable at avesting date and accelerated vesting upon the occurrence of certain events. The exercise price per share equal toof the Bonus Options was based on the fair market value of aper share of common stock on the date of grant (110%)grant.

In July 2017, Milestone Scientific granted to Mr. Goldberger non-qualified stock options to purchase 921,942 shares of the fair market value if the CEO iscommon stock at an exercise price of $2.00 per share. Those options had a 10% or greater stockholderfive-year term and were to vest in equal annual installments on the date of grant). The options shall vest and become exercisable to the extent of one-third of the shares covered at the end of each of the first, three years followingsecond and third anniversaries of the grant date, subject to his continued employment on the vesting date and accelerated vesting upon the occurrence of grant, but shall only be exercisable whilecertain events.

On October 5, 2017, Milestone Scientific announced that Daniel Goldberger had resigned as President and Chief Executive Officer effective October 2, 2017, upon which the CEO is employed bypreviously described stock options granted to him in July 2017 terminated prior to vesting. In February 2018, Milestone or within 30 days afterScientific and Mr. Goldberger signed a Settlement and Release Agreement with respect to Mr. Goldberger’s leaving the terminationCompany. The gross settlement was $175,000, which was paid during 2018.

In July 2017, Milestone Scientific entered into a ten-year new employment agreement with Leonard Osser, who previously served as the Company’s President and Chief Executive Officer, to serve as Managing Director – China Operations. This new agreement provides for annual compensation of his employment.

In accordance with$300,000 consisting of $100,000 in cash and $200,000 in the employment contract, 776,862 shares of MilestoneCompany’s common stock valued at the average closing price of the Company’s common stock on the NYSE American or such other market or exchange on which its shares are then traded during the first fifteen (15) trading days of the last full calendar month of each year during the term of this agreement. This agreement supersedes all prior employment agreements between Mr. Osser and Milestone Scientific. If the Company terminates Mr. Osser’s employment “Without Cause,” other than due to his death or disability, or if Mr. Osser terminates his employment for “Good Reason” (both as defined in the agreement), Mr. Osser is entitled to be paid out atin one lump sum payment as soon as practicable following such termination: an amount equal to the endaggregate present value (as determined in accordance with Section 280G(d)(4) of the contract in settlementCode) of $830,985 at December 31, 2015all compensation pursuant to this agreement from the effective date of termination hereunder through the remainder of the Employment Term.

In July 2017, Mr. Osser also resigned from his positions of Chairman of the Board, Chief Executive Office and 706,716 sharesPresident of Milestone common stock areMedical. Upon his resignation, Milestone Medical entered in a consulting agreement with U.S. Asian Consulting Group LLC, an entity controlled by Mr. Osser, pursuant to be paid out atwhich he will provide specific services to Milestone Medical for a ten- year term. Pursuant to the endconsulting agreement, U.S. Asian Consulting Group, LLC, is entitled to receive $100,000 per year for Mr. Osser's services.

In December 2017, the Board of Directors appointed Leonard Osser Interim Chief Executive Officer, replacing Leslie Bernhard. Mr. Osser will enter into a similar employment contract that he received during 2017 before he resigned his position as CEO of the contract in settlement of $630,985 at December 31, 2014 of accrued deferred compensationcompany. Mr. Osser placed on hold his position as Managing Director-China Operations and accordingly, such shares have been classified in stockholders’ equityhis consulting agreement with the common stock classifiedMilestone Medical to rejoined Milestone Scientific Inc. as to be issued.

12 of 18

This 2009 agreement suspended the previous 2008 employment with 40-months remaining in its term. In March 2014, the 2009 agreement was amended to extend its remaining term to 120-months.

Objective of Executive Compensation Program

The primary objective of the executive compensation program is to attract and retain qualified, energetic managers who are enthusiastic about the mission and culture of the Company.Milestone Scientific. A further objective of the compensation program is to provide incentives and reward each manager for their contribution. In addition, Milestone Scientific strives to promote an ownership mentality among key leadership and the Board.Board of Directors.

The Compensation Committee reviews and approves, or in some cases recommends for the approval of the full Board of Directors, the annual compensation procedures for the Named Executive Officers.

The compensation program is designed to reward teamwork, as well as each manager’s individual contribution. In measuring the Named Executive Officers’ contribution, the Compensation Committee considers numerous factors including the growth, strategic business relationships and financial performance. Regarding most compensation matters, including executive and director compensation, the management provides recommendations to the Compensation Committee; however, the Compensation Committee does not delegate any of its functions to others in setting compensation. Milestone Scientific does not currently engage any consultant to adviceadvise on executive and/or director compensation matters.

Stock price performance has not been a factor in determining annual compensation because the price of Milestone Scientific’s common stock is subject to a variety of factors outside of Milestone’sMilestone Scientific’s control. Milestone Scientific does not have an exact formula for allocating between cash and non-cash compensation.

Annual chief executive officer compensationCEO Compensation consists of a base salary component and periodic stock option grants. It is the Compensation Committee’s intention to set totals for the chief executive officerCEO for cash compensation sufficiently high enough to attract and retain a strong motivated leadership team, but not so high that it creates a negative perception with the other stakeholders. The chief executive officerCEO receives stock option grants under the stock option plan. The number of stock options granted to the executive officer is made on a discretionary rather than a formula basis by the Compensation Committee.

The chief executive officer’sCEO’s current and prior compensation is considered in setting future compensation. In addition, Milestone Scientific reviews the compensation practices of 28 other companies. To some extent, the compensation plan is based on the market and the companies that compete for executive management. The elements of the plan (e.g., base salary, bonus and stock options) are similar tolike the elements used by many companies. The exact base pay, stock option grant, and bonus amounts are chosen in an attempt to balance the competing objectives of fairness to all stakeholders and attracting and retaining executive managers.

13

Outstanding Equity Awards at December 31, 20152018

| Options Awards | Stock Awards | ||||||||||||||||||||||||

Name |

|

Number of Securities Underlying Unexercised Options (#) Exercisable (1) |

|

|

Number of Securities Underlying Unexercised Options (#) Unexercisable (1) |

|

|

Option Exercise Price ($) |

| Option Expiration Date |

|

Number of Shares or Units of Stock that have not vested (#) (2) |

|

|

Market Value of Number of Shares or Units of Stock that have not vested (#) (3) |

| |||||||||

Leonard Osser |

|

| 73,333 |

|

|

| - |

|

| $ | 1.49 |

| 11/20/2019 |

|

| 1,055,135 |

|

| $ | 1,205,707 |

| ||||

|

|

| 185,186 |

|

|

| - |

|

| $ | 2.23 |

| 11/20/2019 |

|

|

|

|

|

|

|

| ||||

|

|

| 57,306 |

|

|

| - |

|

| $ | 3.89 |

| 6/23/2020 |

|

|

|

|

|

|

|

| ||||

|

|

| 64,454 |

|

|

| 18,534 |

|

| $ | 1.72 |

| 2/4/2021 |

|

|

|

|

|

|

|

| ||||

|

|

| 133,134 |

|

|

| 38,286 |

|

| $ | 2.09 |

| 11/10/2021 |

|

|

|

|

|

|

|

| ||||

|

|

| 48,240 |

|

|

| 13,872 |

|

| $ | 1.74 |

| 2/4/2021 |

|

|

|

|

|

|

|

| ||||

|

|

| 186,457 |

|

|

| 150,513 |

|

| $ | 1.14 |

| 1/18/2022 |

|

|

|

|

|

|

|

| ||||

Total |

|

| 748,110 |

|

|

| 221,205 |

|

|

|

|

|

|

|

| 1,055,135 |

|

| $ | 1,205,707 |

| ||||

Gian Domenico Trombetta |

|

| 103,125 |

|

|

| 29,654 |

|

| $ | 1.72 |

| 2/4/2021 |

|

| 202,617 |

|

| $ | 329,863 |

| ||||

|

|

| 77,184 |

|

|

| 22,194 |

|

| $ | 1.61 |

| 12/21/2019 |

|

|

|

|

|

|

|

| ||||

Total |

|

| 180,309 |

|

|

| 51,848 |

|

|

|

|

|

|

|

| 202,617 |

|

| $ | 329,863 |

| ||||

Joseph D'Agostino |

|

| 150,000 |

|

|

| - |

|

| $ | 2.09 |

| 11/11/2019 |

|

|

|

|

|

|

|

| ||||

|

|

| 49,261 |

|

|

| - |

|

| $ | 2.03 |

| 11/20/2019 |

|

| 234,315 |

|

| $ | 406,145 |

| ||||

|

|

| 103,404 |

|

|

| 29,736 |

|

| $ | 1.72 |

| 2/4/2021 |

|

|

|

|

|

|

|

| ||||

|

|

| 38,592 |

|

|

| 11,097 |

|

| $ | 1.61 |

| 1/8/2022 |

|

|

|

|

|

|

|

| ||||

|

|

| 47,946 |

|

|

| 38,704 |

|

| $ | 1.04 |

| 1/8/2022 |

|

|

|

|

|

|

|

| ||||

Total |

|

| 389,203 |

|

|

| 79,537 |

|

|

|

|

|

|

|

| 234,315 |

|

| $ | 406,145 |

| ||||

The following table includes certain information with respect to all unexercised stock options and unvested shares of common stock of Milestone Scientific outstanding owned by the Named Executive Officers at December 31, 2015.2018.

| Options Awards | Stock Awards | |||||||||||||||||||||

Name | Number of Securities Underlying Unexercised Options (#) Exercisable (1) | Number of Securities Underlying Unexercised Options (#) Unexercisable (1) | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock that have not vested (#) (2) | Market Value of Number of Shares or Units of Stock that have not vested (#) (3) | ||||||||||||||||

Leonard Osser | 102,880 | 82,305 | $ | 2.38 | 11/20/2019 | 776,862 | $ | 1,825,626 | ||||||||||||||

| 194,576 | 53,872 | $ | 1.65 | 12/31/2018 | ||||||||||||||||||

| 133,334 | — | $ | 0.75 | 1/9/2017 | — | — | ||||||||||||||||

| 73,333 | — | $ | 1.49 | 11/1/2019 | — | — | ||||||||||||||||

| 19,102 | 38,205 | $ | 3.89 | 6/23/2020 | — | — | ||||||||||||||||

|

|

|

| |||||||||||||||||||

Total | 523,225 | 174,382 | ||||||||||||||||||||

|

|

|

| |||||||||||||||||||

Joseph D’Agostino | 83,333 | 66,667 | $ | 2.09 | 11/11/2019 | 99,631 | $ | 229,151 | ||||||||||||||

| 27,367 | 21,894 | $ | 2.03 | 11/20/2019 | — | — | ||||||||||||||||

| 51,987 | 14,814 | $ | 1.50 | 12/31/2018 | — | — | ||||||||||||||||

| 78,126 | — | $ | 1.28 | 12/31/2017 | — | — | ||||||||||||||||

| 277,778 | — | $ | 0.36 | 12/31/2016 | — | — | ||||||||||||||||

|

|

|

| |||||||||||||||||||

Total | 518,591 | 103,375 | ||||||||||||||||||||

|

|

|

| |||||||||||||||||||

1. | Represents stock option grants at fair market value on the date of grant. |

2. | Issuance of the shares of common stock |

3. | Based on the closing price per share |

PROPOSAL NO. 3

ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION

(ITEM 3 ON THE PROXY CARD)

General

We are providing our stockholders with the opportunity to vote to approve, on an advisory, non-binding basis, the compensation of our Named Executive Officers as disclosed in this Proxy Statement in accordance with the Securities and Exchange Commission’s (“SEC”) rules. This proposal, which is commonly referred to as “say-on-pay,” is required by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, which added Section 14A to the Exchange Act). Section 14A of the Exchange Act also requires that stockholders have the opportunity to cast an advisory vote with respect to whether future executive compensation advisory votes will be held every one, two or three years, which is the subject of Proposal No. 3.

The primary objective of our executive compensation program is to attract and retain qualified, energetic managers who are enthusiastic about the mission and culture. A further objective of the compensation program is to provide incentives and reward each manager for their contribution. In addition, Milestone strives to promote an ownership mentality among key leadership and the Board. The “Executive Compensation” section of this Proxy Statement describes in detail our executive compensation programs with respect to the fiscal years ended December 31, 2015 and December 31, 2014.

TheDirector Compensation Committee reviews and approves, or in some cases recommends for the approval of the full Board, the annual compensation of the Named Executive Officers.